5 Takeaways From Nike Founder Phil Knight's 'Shoe Dog' Memoir Phil Knight delves into his past in this memoir and gives us a never-before-seen look at what it was like to bring Nike to where it is. Nike delivers innovative products, experiences and services to inspire athletes. Free delivery and returns on every order with Nike Membership.

Nike Memorial Day

From time to time in the academic accounting domain there is a tendency to forget that accounting is not a stand-alone discipline. Phil Knight's book, Shoe Dog: A Memoir by the Creator of Nike (hereafter, Shoe Dog), is a refreshing reminder that accounting does not exist in a vacuum, but rather is one among many players in the symphony of commerce. Shoe Dog is also particularly relevant and relatable, because the author and founder of this iconic global shoe and sportswear company (and one of the world's most successful businesspersons), has a background in both public accounting and tertiary accounting education. Whether Nike's success is “because of” or “despite” Knight's accounting background, I leave to each reader to assess.

For consumers of business books, Shoe Dog provides an annotated chronology of the founding and development of one of the world's most valuable business brands. Accounting academics reading Knight's memoir will nod knowingly at the anecdotes, dilemmas, and challenges recounted in Shoe Dog that emphasize the relevance of the tale, especially for those with practice experience. For students reading (while wearing their Nikes), it engrossingly illustrates accounting's inter-relationships with entrepreneurship, marketing, logistics, manufacturing, finance, company law, and, importantly, ethics. For all readers, Shoe Dog satisfies with components germane to all successful literature: heroes, villains, suspenseful situations, and a reasonably happy ending.

As such, Shoe Dog is a fine candidate to augment an accounting course—although at first glance this would not seem obvious. After all, there are no financial statements, no worksheets, and no data of any consequence. Rather, and as titled, Shoe Dog is a “memoir,” not a how-to business book or instructional guide. So what aspects of Shoe Dog make it appropriate for traditionally numbers-based classes? One great strength, which is understated, is Knight's apparent honesty. Amid a plethora of business books from or about executives that are essentially hagiographies in which the executive seldom if ever commits an error or misstep, Shoe Dog is different. While it does not dwell extensively on the numerous pitfalls that Knight encountered in building his company, Shoe Dog doesn't shy away from acknowledging and discussing Knight's missteps. Indeed, Knight—still known to his family and friends as “Buck” despite now being business royalty—is disarmingly candid about the dilemmas encountered by his company, some of which were caused or exacerbated by his own decisions and behavior. Students reading Shoe Dog will discover an extremely successful individual who acknowledges his shortcomings and an accountant who has the creativity and courage needed to embark on a highly uncertain enterprise. Students who might know of the adage that “accountants know the price of everything but the value of nothing” will see this negative stereotype disabused by Knight, who demonstrated a commitment to both what he termed a “crazy idea” and a small cadre of loyal associates to build a company with innovative products and highly satisfied customers. Phil Knight worked for two public accounting firms and obtained a CPA, following his father's exhortations to pursue a respectable and stable career. He also followed his passions. As a role model, Knight demonstrates to students that studying accounting equips one for career success and not just accounting career success. For this and other reasons to be touched upon later in this review, undergraduate students will find Shoe Dog to be an inspirational accompaniment to traditional accounting textbooks.

Shoe Dog also imparts great value when instructing M.B.A. and executive education students. While not occupying center stage, it would be difficult to envisage making the same kind of successful decisions that Knight made without having similar accounting knowledge and experience. There is also immediate kinship in that Knight was an M.B.A. student (Stanford) and the idea for a shoe company germinated from a course requirement. M.B.A. students and instructors alike will appreciate Knight's comment that “as required, I'd given a formal presentation of the paper to my classmates, who reacted with formal boredom. Not one asked a single question. They greeted my passion and intensity with labored sighs and vacant stares” (p. 10). At least the professor rewarded Knight's vision with an “A.” M.B.A. students and executives also can fruitfully reflect on their own business problems while reading about Knight describing his. As a memoir, the book is good at illustrating that although there was no clearly laid out path for Knight to follow, his success was not random. Various incidents show how Knight, when faced with a dilemma, needs to triumph over minor adversities before he moves on to the next big battle. Nike is not a get-rich-quick story, although it certainly qualifies as a rags-to-riches tale. When reading Shoe Dog, and recognizing that most start-up companies fall by the wayside, Nike's success, which was (and still is) by no means assured, is noteworthy. The constant refrain of “Liquidity, liquidity, liquidity” will be very familiar to work-experienced students who read the book. Classroom discussion can also note the soft-skills aspects of building Nike, and, thus, emphasize the integrated nature of business skills.

Nike Memorial Day Tournament

After a brief and proud preamble about growing up in Oregon, earning a degree from the University of Oregon and running on its track team, obtaining an M.B.A. from Stanford University, and serving in the U.S. Army for a year, Shoe Dog moves on quickly to Knight's trials and tribulations in pursuing his Crazy Idea (as he capitalizes it). He sells most of his worldly possessions, taps into financing from his father, and embarks on a trip around the world. He is initially surprised that his father will help fund his expedition, but his father explains that he wished he had traveled more he was when young. Knight and a Stanford classmate embark on their trip, but get no further than a first stop in Hawaii. Enjoying the environment and aspirational surfers, they decide to stay. To finance their now primary goal of pursuing surf, sand, and sun, they get jobs as—this is too clichéd to make up—encyclopedia salesmen. The shy and reticent Knight doesn't quite excel at this endeavor. In fact, he didn't make a single sale. Realizing that selling encyclopedias wasn't a good match for his skills, he became a mutual funds salesman for Investors Overseas Services (yes, that Investors Overseas Services) headed by the eventually indicted (but acquitted), larger-than-life character Bernie Cornfield. This short, and casually mentioned anecdote, could have segued into a discussion of meeting the precursors of Enron, Bernie Madoff, etc., but Knight merely drops this factoid as support for his belief that it is necessary to find the right fit for one's abilities. This is one of many instances of small incidents that could be the basis for classroom discussion.

The book is structured chronologically, with chapters titled for the year of the events being recounted. The opening chapter is “1962,” and after describing his and his traveling companion's stop in Hawaii, Knight proceeds, solo, to visit Japan to discover whether the Japanese can make shoes to the same quality as the benchmark of Germany. Tokyo in 1962 seems like distant history, but it was only 17 years after the end of World War II. Knight's descriptions of Tokyo resonate with desolate stretches of bombed buildings as Knight laments the tragic costs of war by numerous measures.

It is in Tokyo that the book starts to really connect. Through his father's contacts in Tokyo, Knight learns local customs and business practices. For M.B.A.s, it reminds us that sometimes “it's not what you know, it's who you know.” With a modicum of local knowledge, Knight secures an appointment with the Onitsuka shoe factory in Kobe. After a quick misstep into the Onitsuka showroom rather than factory, Knight arrives late for his appointment, and after a brief factory tour, is taken to a conference room, given the seat of honor, and begins to deliver the same presentation he made for his Stanford classmates. Within seconds, Onitsuka executives interrupt and to, as a matter of politeness and local custom, inquire what company Knight represents. On the spot, Knight makes up the name Blue Ribbon Sports of Portland, Oregon. Duly impressed, Onitsuka executives make Blue Ribbon Sports their Northwestern U.S. distributor. Knight orders $50 in samples to be shipped to Oregon, again funded by his father.

On returning home to Portland, Knight needs a job, and with guidance and advice from family friends, he lands one at Lybrand, Ross Bros. and Montgomery (later Coopers & Lybrand, then PricewaterhouseCoopers, and now doing business as PwC—the evolution of accounting firms being another topic for class discussion). But Knight lacks an accounting degree to sit for the CPA exam, so he enrolls at Portland State University, qualifies, and takes a stable job that pays reasonably well, with his “Crazy Idea” still on his mind. When his $50 sample order finally arrives by ship from Japan, he lands his first sale to his mother, in a maternal show of support, in front of his dubious father. As later chapters recount, recurring problems with shipping delays and securing funding to pay for goods in transit grow, grow, and grow.

Claquette Nike Memoire De Forme

As a solid varsity performer at the University of Oregon, Knight is in his element when marketing athletic shoes to more elite runners. His direct knowledge about sports provides for easy rapport, and armed with a good product at a good price, sales of Onitsuka shoes prove successful. Assisting in this success is his former University of Oregon track coach, Bill Bowerman, who likes the product—and likes the business potential. Bowerman and his former student runner become 50-50 partners in (now incorporated) Blue Ribbon Sports. Teaming up with Bowerman is fabulously fortuitous for Knight as Bowerman is nationally well regarded by athletes. In addition, Bowerman likes to tinker with shoe design and structure, and later helps to develop a new best-selling model for the fledgling company, with plenty of twists and turns along the way.

In 1964 Knight faces the possibility of a quick demise of Blue Ribbon Sports because a high school wrestling coach is granted exclusive rights to Onitsuka distribution in the United States. Knight flies to Japan in an attempt to hold his position and, by chance, meets Mr. Onitsuka. The founder of the eponymous shoe company overrules his lieutenants and grants Knight exclusive distribution rights for Onitsuka athletic shoes in the western United States, with a rival distributor on the East Coast who is also allowed to sell wrestling shoes across the U.S. This incident foreshadows a similar near-death threat to Nike later in the book, but there is much in between. In these early chapters, Knight also discusses his personal life, with 1964 also devoted to nursing a broken heart.

Beginning with chapter 1965, Knight recounts the growth of Blue Ribbon Sports as he manages part-time commissioned salesmen, one of whom is an athletic acquaintance from years earlier. Jeff Johnson is full of initiative, and correspondence. He writes Knight regarding advertising, sales ideas, marketing approaches, and he continues to write, despite the fact that Knight rarely responds, and never with encouragement. Johnson informs Knight in one of his letters that he has quit his permanent job in order to sell shoes full time. This alarms Knight, as he is busy trying to sustain his young enterprise and is not in a position to hire full-time employees. But Johnson perseveres, and is the first of a small cadre of what might be deemed eccentric characters who coalesce as the core of Knight's infant company. Later in Shoe Dog, Knight reveals that they called themselves “Buttfaces,” since yelling “Hey! Buttface!” would get management to look in their direction (also a good talking point for a management or human resources class).

Nike Memorial Day Classic 2021

In 1966 Knight's original two-year distribution agreement with Onitsuka was set to expire. At the behest of Johnson, Knight flew to Japan (financed by credit card debt) to meet with Onitsuka executives. His former champion at Onitsuka was no longer there, and the replacement, a man named Kitami, assumed the role of lead negotiator. With allusions to a (non-existent) Blue Ribbon Sports East Coast office, and pending Midwest expansion, Knight obtains a three-year distribution agreement. He appoints Johnson, who had successfully created a Blue Ribbon Sports store in Los Angeles, to head up the effort. But as Blue Ribbon grows, cash flows lag—nicely illustrating a classic startup liquidity trap.

By 1967, as Blue Ribbon Sports opens its first office, Knight can't afford to fix its broken windows, nor pay himself a salary. Working for his second Big 8 firm, Price Waterhouse, to pay bills, Knight concludes that public accounting hours are hampering his shoe business and resigns, but not from accounting. He obtains employment at Portland State University as an assistant accounting professor. Besides a steady paycheck and more free time for his shoe passion, Knight meets his future wife who is his student—more topics for discussion.

Nike Memorial Day Coupon

After a year as professor at Portland State, Knight leaves academe to devote himself full time to his company, but not without challenges. Externally, the bankers for Blue Ribbon end their relationship, citing too much exposure, labeling phenomenal sales increases as exposure risk versus promising development (a discussion topic for finance). Fortunately, as one group of financiers (retail bankers) abandon Blue Ribbon Sports, Onitsuka sees an opportunity to control everything, and squeeze Knight out of his own business. Knight's point-of-contact at Onitsuka, Kitami, visits the Portland office on a tour of the U.S. to ostensibly learn more about the market. But Knight obtains access to Kitami's briefcase, and discovers that Kitami has in fact arranged appointments with other potential distributors. Clearly an unethical act (with ample room for discussion), Knight realizes that he must devise a means to divorce Onitsuka and pursue his own shoe manufacturing. Knight creates a new entity to be separate from Blue Ribbon Sports, and settles on the name suggested by his colleagues, “Nike,” the goddess of sport. Knight commissions an art student he knew at Portland State University to create a logo for the new company, with the mandate of “something that evokes a sense of motion.” One of the submissions is selected by Knight and colleagues, and the designer is paid $35 for the now-famous swoosh.

Kitami eventually discovers that Knight is operating a separate company that, while not directly violating the Onitsuka distribution contract, positions them as competitors. Treachery abounds in the flagging relationship, which ultimately winds up in court. Unfortunately for Knight, in an effort to bolster staff morale, he documented that an insider at Onitsuka in Japan provided him with information, and referred to him as a “spy” (with lessons here in both business conduct and business communications). Despite claims by Kitami that supported their position (claims that were, in fact, falsehoods), the judge ruled in favor of Blue Ribbon Sports. But before damages could be determined, Otsuka's legal representatives offered a settlement that provided Nike with funding that, in Knight's words, ultimately put “more shoes on the water,” from China—but not before more liquidity crises. Ultimately Knight prevails in setting Nike on a relatively stable financial footing, and innovates both manufacturing and marketing. In marketing, Nike is particularly successful in securing endorsements from celebrity athletes, and enticing college coaches to outfit their teams in Nike shoes and apparel. The life of Nike, by the end of the 1970s, is no longer the day-to-day liquidity squeeze of a startup.

Throughout the book, the astute reader will question why Knight didn't take his companies public in order to alleviate their perennial funding problems. When the issue is discussed finally in Chapter “1980,” Knight's reasoning is that he did not want to lose control of his vision and where the company should go. It is an interesting contrast to today, where companies such as Google, Facebook, and Alibaba go public with differential voting rights. In this, Nike was also a pioneer. Its 1980 stock offering was in two classes to preserve what Knight referred to as “one voice” in running the company. After the successful offering, Knight commented that he wished he could do it all over again. For Knight, the journey was the reward, not the destination (also an important learning discussion).

Shoe Dog: A Memoir by the Creator of Nike is thus more than a hard-edged, self-praising business biopic. It is rather an honest and personal tale chock-full of candid discussion points regarding business tools, business philosophy, good versus evil morality, and sadness as well as success. As a supplemental accounting text, it provides an inspiring and connecting (who isn't a Nike customer?) “real-life” journey with an accountant and accounting academic who creates a globally recognized brand and business empire through the use of accounting insights and perspectives.

Overview

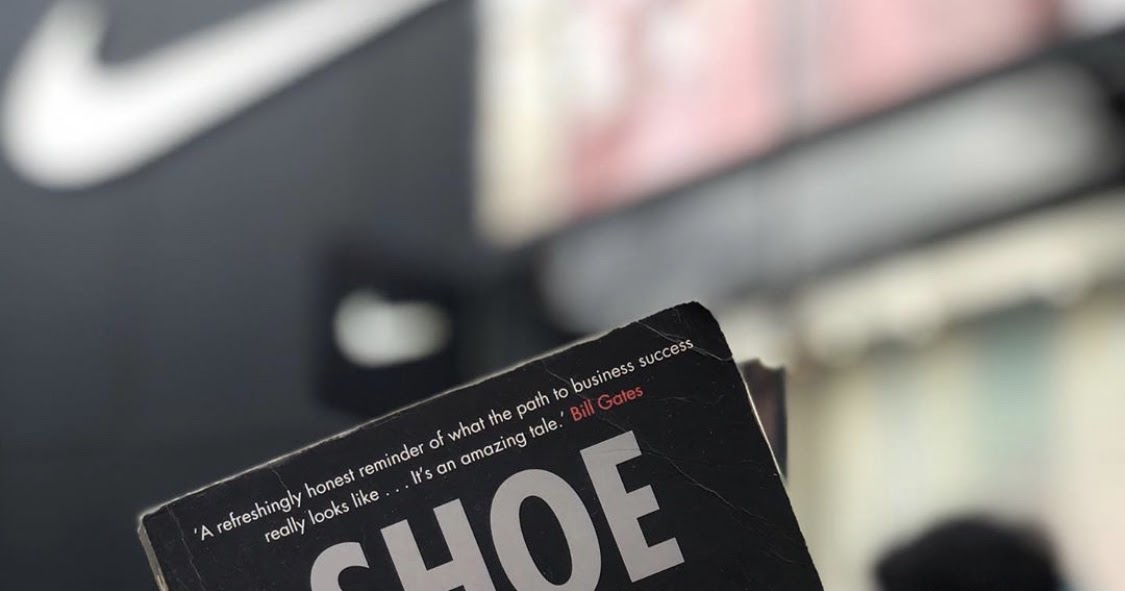

Bill Gates named Shoe Dog one of his five favorite books of 2016 and called it “an amazing tale, a refreshingly honest reminder of what the path to business success really looks like. It’s a messy, perilous, and chaotic journey, riddled with mistakes, endless struggles, and sacrifice. Phil Knight opens up in ways few CEOs are willing to do.”

Fresh out of business school, Phil Knight borrowed fifty dollars from his father and launched a company with one simple mission: import high-quality, low-cost running shoes from Japan. Selling the shoes from the trunk of his car in 1963, Knight grossed eight thousand dollars that first year. Today, Nike’s annual sales top $30 billion. In this age of start-ups, Knight’s Nike is the gold standard, and its swoosh is one of the few icons instantly recognized in every corner of the world.

But Knight, the man behind the swoosh, has always been a mystery. In Shoe Dog, he tells his story at last. At twenty-four, Knight decides that rather than work for a big corporation, he will create something all his own, new, dynamic, different. He details the many risks he encountered, the crushing setbacks, the ruthless competitors and hostile bankers—as well as his many thrilling triumphs. Above all, he recalls the relationships that formed the heart and soul of Nike, with his former track coach, the irascible and charismatic Bill Bowerman, and with his first employees, a ragtag group of misfits and savants who quickly became a band of swoosh-crazed brothers.

Together, harnessing the electrifying power of a bold vision and a shared belief in the transformative power of sports, they created a brand—and a culture—that changed everything.